2025 California Estimated Tax Worksheet - For the 2025 tax year, the effective california property tax rate was 0.75%. Calculating Estimated Taxes 20222025, In 2025, estimated tax payments are due april 15, june 17, and september 16. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties.

For the 2025 tax year, the effective california property tax rate was 0.75%.

Total income expected in 2025 is your estimated federal adjusted gross income.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Generally, a fiduciary of an estate or trust must pay estimated tax if the estate or trust is expected to owe at least $1,000 in tax for 2025 and. The income tax estimator will.

2025 California Estimated Tax Worksheet. For the 2025 tax year, the effective california property tax rate was 0.75%. The amount of tax, after all credits, that you expect will be shown on your oregon income tax return.

20222025 Form OK OW8ESSUP Fill Online, Printable, Fillable, Blank, Individuals who are required to make estimated tax payments, and whose 2025 california adjusted gross income is more than $150,000 (or $75,000 if married/rdp filing. An annual payment or an.

Form 540 instructions pdf Fill out & sign online DocHub, • the instructions for the 2025 estimated tax worksheet. Calculate the tax withheld and estimated to be withheld during 2025.

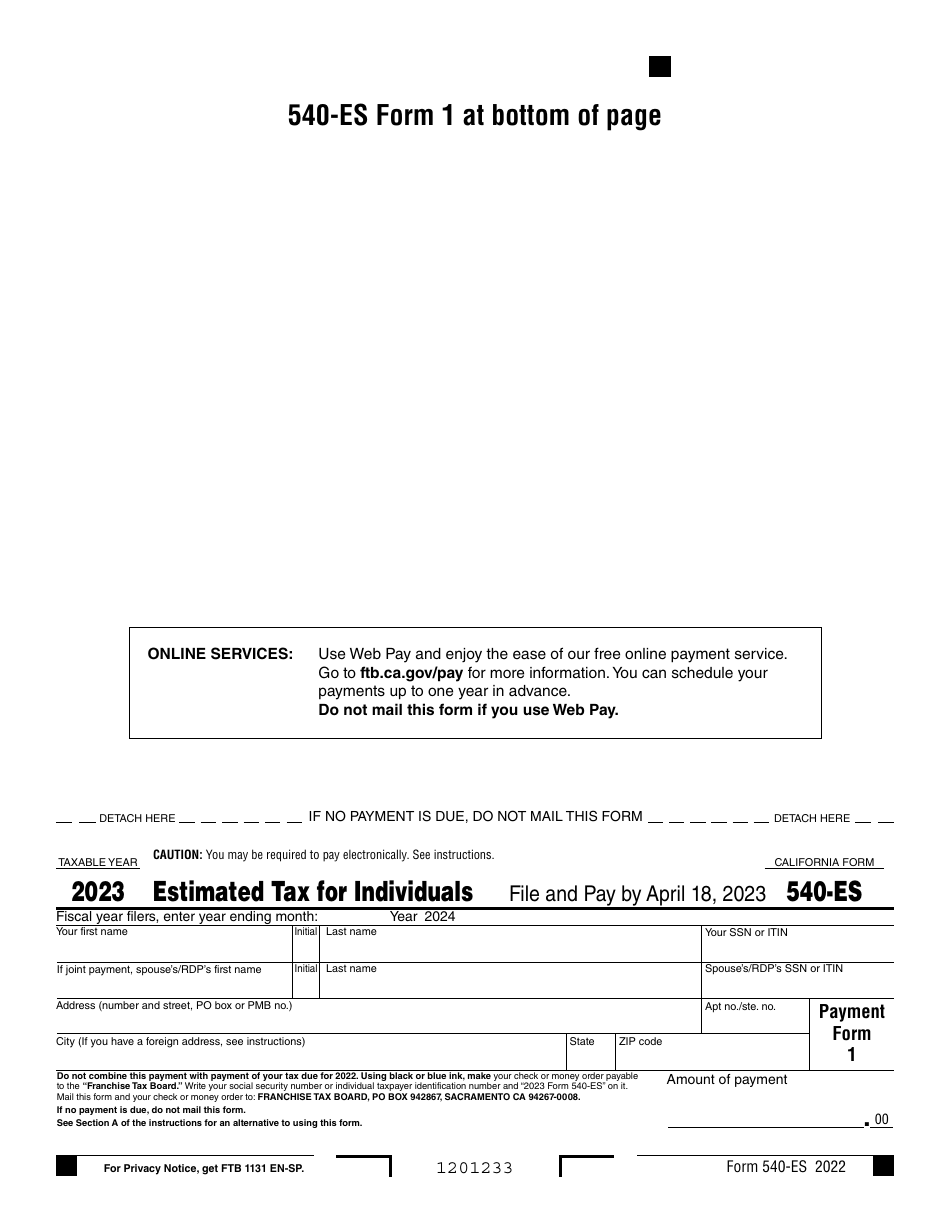

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Fiscal year filers, enter year ending month: The amount of tax, after all credits, that you expect will be shown on your oregon income tax return.

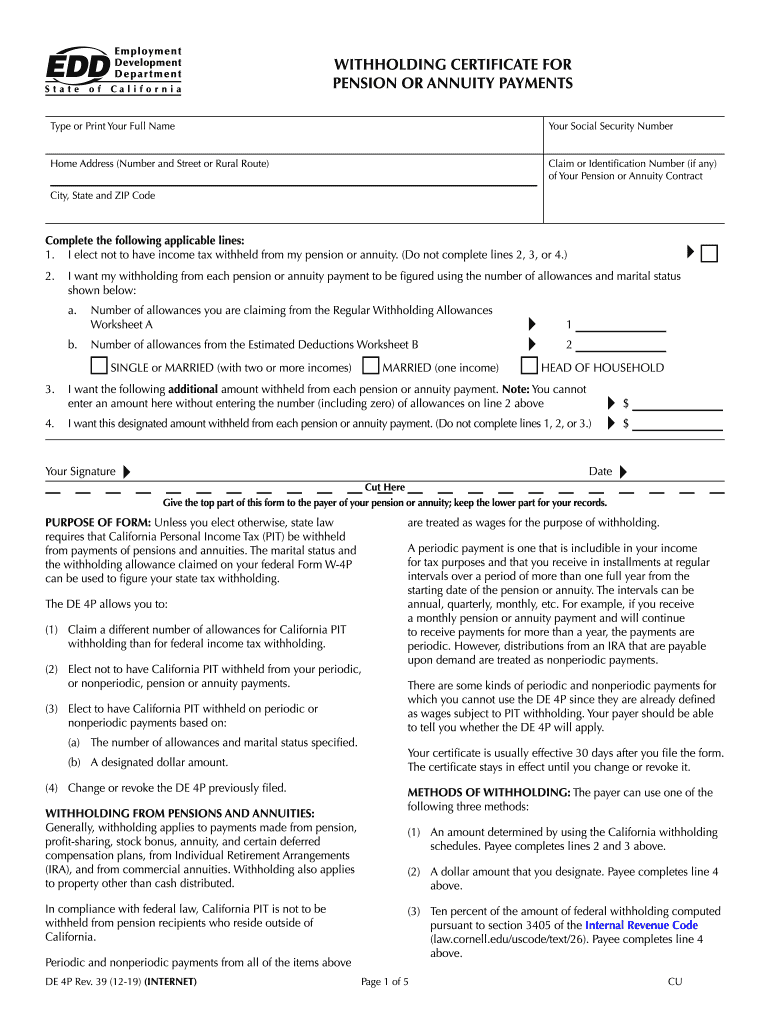

20192025 Form CA EDD DE 4P Fill Online, Printable, Fillable, Blank, (note that the fourth quarter deadline is in the. The irs today announced that taxpayers in california affected by severe storms and flooding that began on january 21, 2025, now have until june 17, 2025, to.

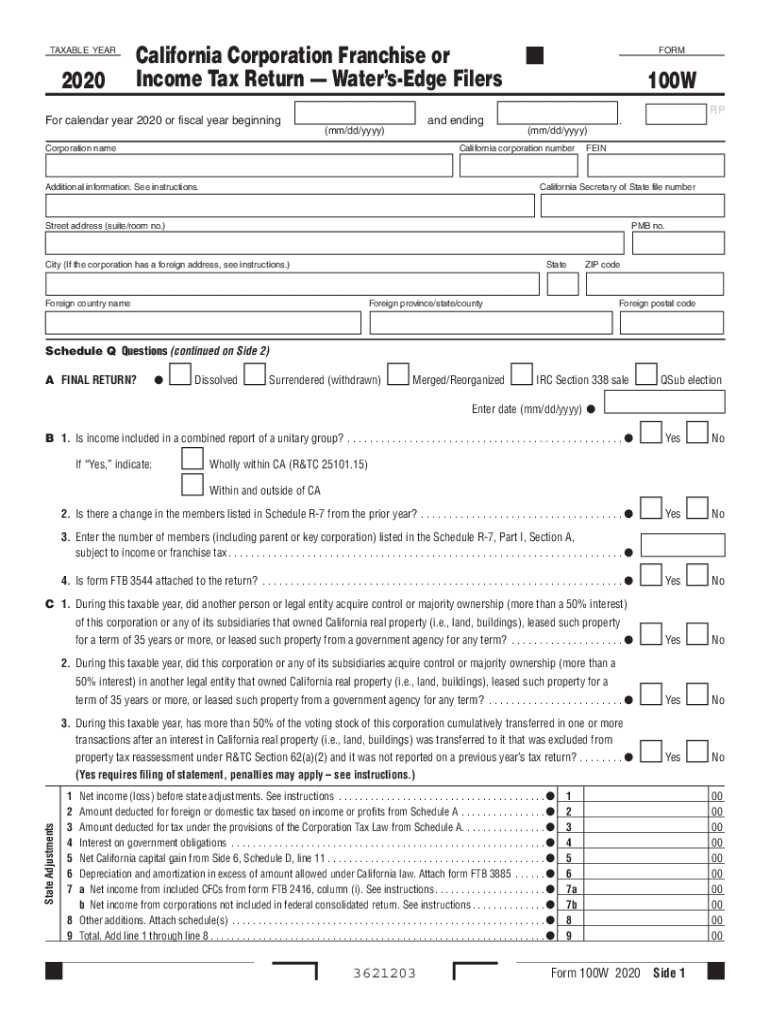

California 100w Fill out & sign online DocHub, Contact your employer to request the amount that will be withheld on your wages based on the marital. An annual payment or an.

Form 540ES Download Fillable PDF or Fill Online Estimated Tax for, Use the 2025 estimated tax worksheet and 2025 tax rate schedule, later, and the estate’s or trust’s 2025 tax return and instructions as a guide for. With a median housing price of around $715,900 last year, the median amount of state.

$250 if married/rdp filing separately. Generally, you must make estimated tax payments if in 2025 you expect to owe at least:

Generally, a fiduciary of an estate or trust must pay estimated tax if the estate or trust is expected to owe at least $1,000 in tax for 2025 and.

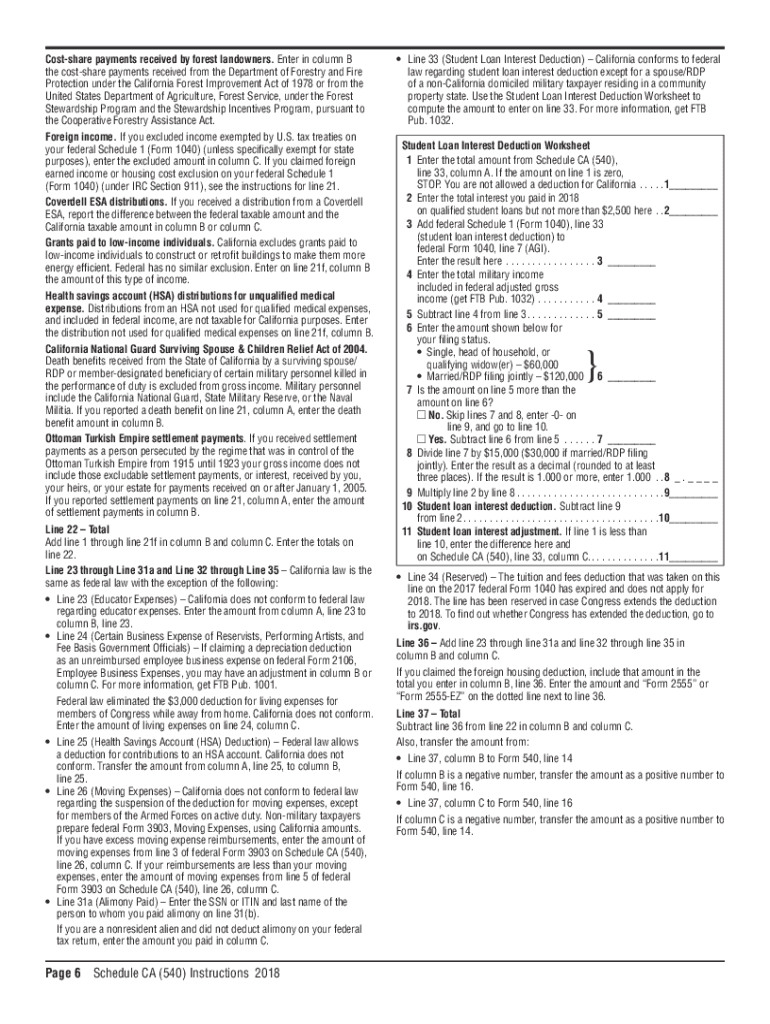

20182025 Form CA FTB 540 Instructions Fill Online, Printable, Fillable, • the 2025 tax rate schedules for your filing. California provides two methods for determining the amount of wages and salaries to be withheld for state personal income tax:

2025 California Tax Brackets Table Maren Sadella, You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year.

Generally, a fiduciary of an estate or trust must pay estimated tax if the estate or trust is expected to owe at least $1,000 in tax for 2025 and.